The last few years have seen an increase in pension scam activity, with savers being pressured into transferring their pensions into arrangements that might seem legitimate and promise a lot, but which result in people losing their money. We want you to be aware of the risks and know what to do if you’re suspicious.

Signs of a scam include:

- Unsolicited contact. A genuine financial adviser or institution will not call, email or write to you out of the blue.

- Unrealistic promises. Be wary of any investment that offers guaranteed high returns – these are unlikely to be true.

- Unreasonable pressure. Scammers will often try to force you into a quick decision or rash commitment with a “limited time offer”.

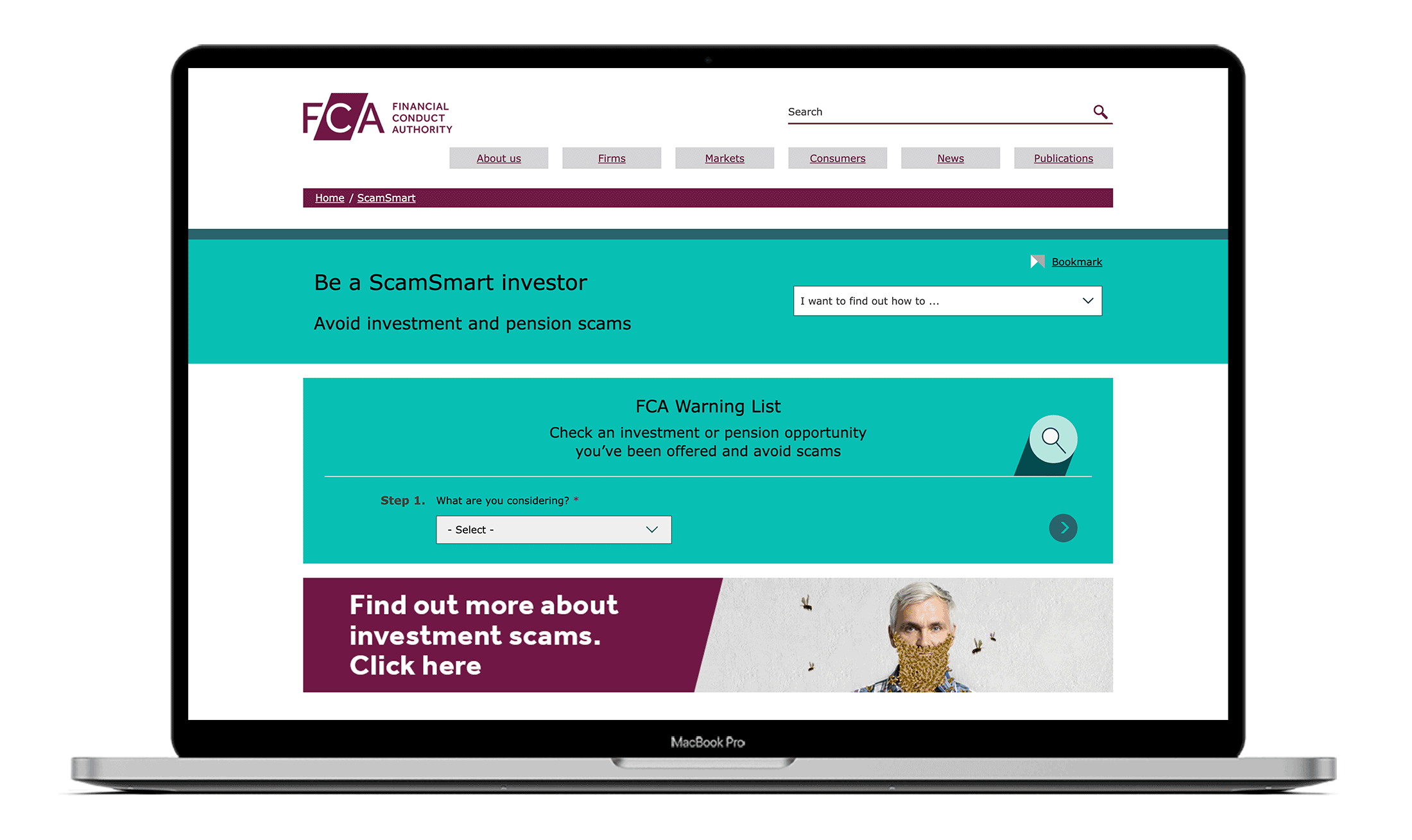

You should take your time and always check who you’re dealing with. You can use the Financial Conduct Authority’s ScamSmart website, fca.org.uk/scamsmart, to access the register of firms and individuals who are authorised to give you financial advice.

The ScamSmart website also gives you instructions for what to do if you think you’ve been targeted. You can also report a scam (or attempted scam) to Action Fraud. Call 0300 123 2040 or use the online reporting tool on the Action Fraud website: actionfraud.police.uk